malaysia rental income tax deductible expenses

For private property house the related expenses are deemed to amount to a standard amount of SEK 40000 and 20 of the. The capital gains tax in 2011 was 28 on realized capital income.

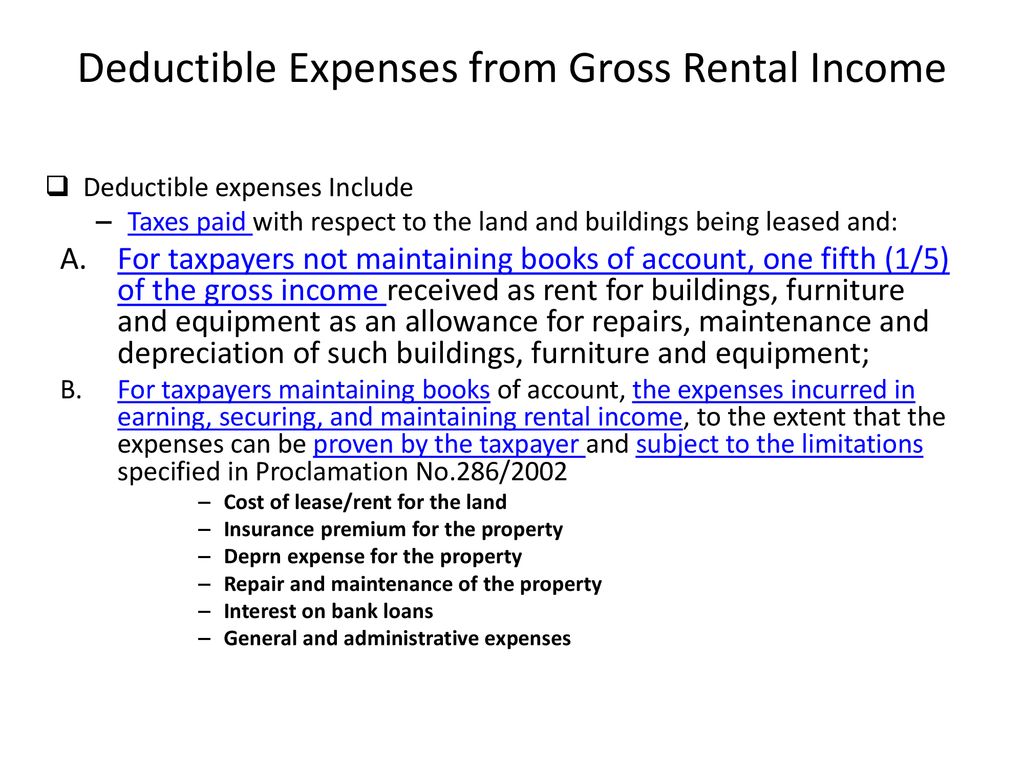

Rental Income Tax Accounting Ppt Download

Income Tax Act 1959 No.

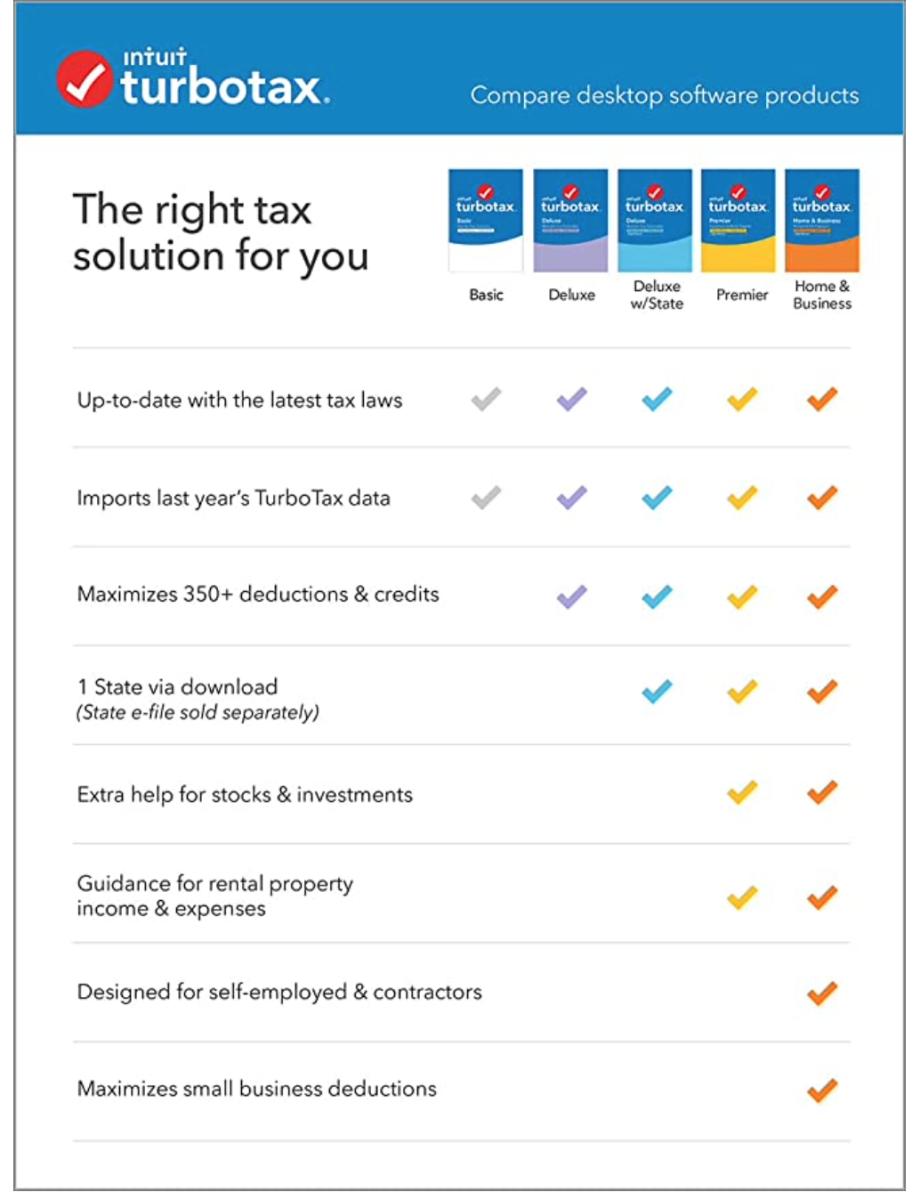

. There are virtually millions of. This is to prepare for a possible audit by tax authorities in the future. Pays for itself TurboTax Self-Employed.

Non-business expenses for example domestic or household expenses and taxes are not deductible. Income Tax Act 1959. Many countries levy income tax on this basis.

Use this form to claim a refund of the fuel excise and GST you paid on fuel. This is effected under Palestinian ownership and in accordance with the best European and international standards. Complete an Application for refund under Indirect Tax Concession Scheme ITCS Fuel claim form NAT 3152.

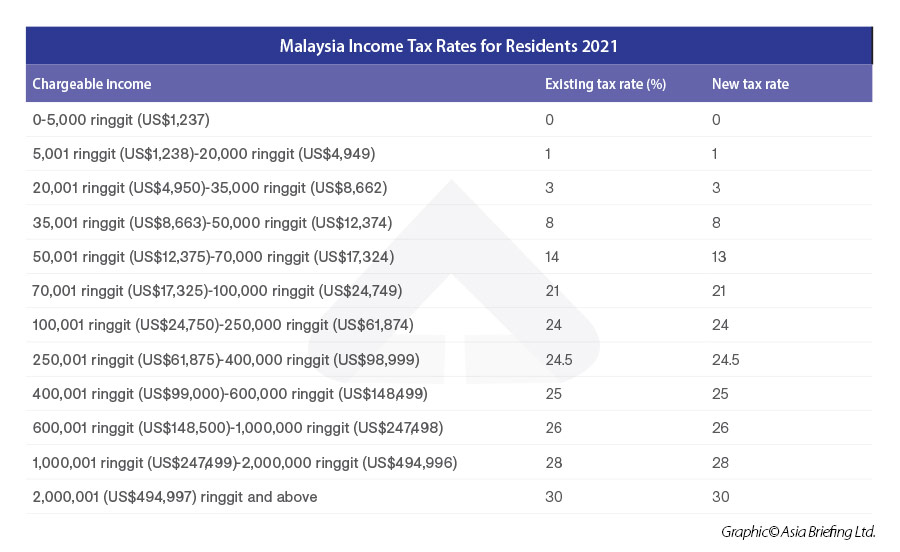

The income tax rate for resident legal persons is 20 payment of 80 units of dividends triggers 20 units of tax due. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. A traders operating losses constitute broadly the excess of his operating expenditure over receipts from his operations. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e.

Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Use the Running sheet for cash purchases of fuel to record cash purchases of fuel. Prescribed expenditure of a personal nature is not deductible.

Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

Example Company A entered into a lease agreement to rent an office space for 2 years with a monthly rental of 5000 for 2019 and 2020. Rental Income Deductible Expenses. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without.

Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. Recovery tax is an additional tax that is used to repay all or part of the OAS pension received by higher-income pensioners. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without.

Expenses paid by tenant occur if your tenant pays any of your expenses. The landlords falling under this category are required to pay residential rental income tax at a flat rate of 10 on the gross rental income such that no tax-deductible expenses are allowed. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

For income tax purposes your company should claim tax deductions based on contractual rental payments regardless of how such expenses are recognised in its accounts. Donations to approved institutions or organisations are deductible subject to limits. NET INCOME -- Net income is gross income less deductible income-related expenses.

Rental Income Deductible Expenses. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income. The capital gains tax in Finland is 30 on realized capital income and 34 if the realized capital income is over 30000 euros.

You can deduct the expenses if they are deductible rental expenses. Ps please give me contact details of a. I have closed my tax file in Malaysia when I relocated to Thailand.

This relief includes domestic travel expenses incurred during the period between March 1 2020 until December 31 2022--Before claiming the tax reliefs above remember to keep all proof of spending such as statements invoices and receipts. However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible. Tax is assessed on annual rentals and other income received from the real property after deduction of related expenses.

Recovery tax is in addition to non-resident tax. Worldwide rental income from the letting of private property is normally considered as capital income. This tax is 15 of the amount of a pensioners net world income that is more than CAN79845.

The expenses that are income tax deductible including. Actual results will vary based on your tax situation. The Finance Act 2020 increased the threshold for the annual gross rental income from KES 10 million or less to KES 15 million or less.

An estimated 50 of Irans GDP was exempt from taxes in FY 2004. For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. For tax years beginning after 31 December 2025 the percentage of modified taxable income that is compared against the regular tax liability increases to 125 135 for certain banks and securities dealers and allows all credits to be applied in determining the US corporations regular tax liability.

Then I would pay tax on my irish rental income and because i will be resident in thailand my state oap would go under the radar. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. 50 not more than 100000 THB.

My support is about THB. Mortgage interest incurred to finance the purchase of a house is deductible only if income is derived from. In general expenses incurred for the production of business income are tax deductible.

Shall specify the currency or currencies in which the income and expenses are to be reported and may apply to all or to any specified activities of that person. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. An entity which provides insurance is known as an insurer an insurance.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Expenses that were not incurred in the production of profits. Vehicle insurance may additionally.

Personal Income Tax Number. You must include them in your rental income. The expenses that are income tax deductible including.

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. Company Tax Deduction 2021. NET OPERATING LOSS -- Amounts by which business expenses exceed income in a tax year.

Features Of The Chinese Personal Annual Income Tax Settlement Rodl Partner

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Taxplanning So You Want To Start Your Own Business The Edge Markets

Doing Business In The United States Federal Tax Issues Pwc

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Benefits Of Owner Occupied Rental Property Duplex Triplex Four Plex

Personal Tax Relief 2021 L Co Accountants

Special Tax Deduction On Rental Reduction

Global Rental Income Tax Comparison

Must You Declare Your Rental Income To Lhdn Landlord Tax Incentives Iproperty Com My

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Property Rental Income Tax In Portugal For Foreign Owner Investors

Individual Income Tax Amendments In Malaysia For 2021

Which Version Of Turbotax Do I Need Toughnickel

.jpg)

Financing And Leases Tax Treatment Acca Global

Airbnb Rental Income Statement Tracker With Expense Etsy

0 Response to "malaysia rental income tax deductible expenses"

Post a Comment